The MT103 wire transfer is one of the most recognized and trusted global payment instructions used for international bank-to-bank transactions. It is part of the SWIFT (Society for Worldwide Interbank Financial Telecommunications) messaging system, which allows banks worldwide to communicate standardized financial transaction information securely.

MT103 is used when funds are being transferred from one bank account to another across different countries, ensuring the recipient and all intermediary banks have clear, verifiable payment details.

This document acts as a traceable proof of payment, showing who sent the funds, who is receiving them, the amount, the date, and the route taken through the financial network.

Purpose of an MT103

The MT103 is issued to:

- Confirm that an international bank transfer has been successfully initiated

- Provide transparent proof of payment to the receiving party

- Ensure that all intermediary clearing banks recognize the transaction

- Assist in tracking delays, verification, or compliance checks

This makes the MT103 especially important in:

- Cross-border commercial purchases

- International asset acquisitions

- Corporate settlement agreements

- Government and institutional transactions

- High-value brokerage and contract deals

What Information MT103 Contains

An MT103 form includes:

| Field | Description |

|---|---|

| Sender Bank Details | The bank sending the funds |

| Receiver Bank Details | The destination bank information |

| Sender & Beneficiary Names | Individuals or entities involved |

| SWIFT/BIC Codes | Identifiers for global bank routing |

| Amount & Currency | Value being transferred |

| Transaction Reference Code (TRN/UTR) | Unique identifier used to track the transfer |

| Intermediary Bank Info | Banks involved in routing the funds between countries |

This level of detail ensures full transaction accountability.

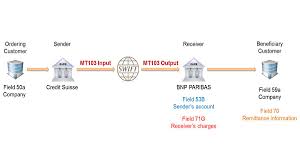

How MT103 Works

1. Transfer Initiation

The sender requests the bank to wire money internationally.

2. SWIFT Messaging

The bank sends the MT103 message through the SWIFT network to the receiving bank.

3. Intermediary Routing

If banks do not have a direct relationship, funds pass through correspondent banks.

4. Receipt & Posting

The receiving bank verifies the details and posts the funds to the beneficiary’s account.

5. Confirmation

The sender can request the MT103 receipt to confirm the transfer path.

Why MT103 Is Trusted Globally

- It is recognized and used worldwide

- It cannot be forged or modified without bank-level authorization

- It allows full transaction traceability

- It satisfies compliance and anti-fraud requirements

- It enables proof of payment, even if funds have not reached the final account yet

This makes MT103 extremely important in international business negotiations.

MT103 vs MT202 — Key Difference

| Feature | MT103 | MT202 |

|---|---|---|

| Purpose | Customer-to-bank payment | Bank-to-bank settlement |

| Contains Beneficiary Info | Yes | No |

| Used For Proof of Funds | Yes | Not suitable |

| Transparency Level | High | Limited |

Professionals dealing in high-value transactions always request the MT103, not MT202, if they need traceable proof.

Security Considerations

MT103 transactions are protected under:

- SWIFT encrypted communication

- Global anti-money laundering compliance

- Bank-authorized transaction verification

This ensures that MT103-based payments are authenticated, traceable, and secure for both sender and receiver.

Conclusion

The MT103 wire transfer remains the standard method for secure, transparent, and internationally recognized bank-to-bank payments. Its ability to serve as official proof of payment makes it critical in corporate, legal, investment, and international trade environments.

📩 For Consultation, System Tools & Transaction Support

Email: support@sqr400flashfund.com

Telegram: https://t.me/Sqr400_FlashFund

WhatsApp: https://wa.link/rllagr

Refrence

- https://articles.sqr400flashfund.com/2025/11/07/sqr400-flash-system/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-v5-8-v7-8-4/

- https://articles.sqr400flashfund.com/2025/11/08/bank-display-synchronization-tool/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-flash-fund-v5-8/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-flash-fund-v7-8-4/

2 thoughts on “MT103 Wire Transfer — Understanding How International Payment Protocols Operate”