The world of international finance demands sophisticated tools that can handle complex transactions while maintaining the highest security standards. The Sqr400 Flash Fund App represents a breakthrough in professional banking software designed for global financial operations. With over 15 years of development and continuous refinement, this powerful platform has become an essential tool for financial professionals, international traders, and businesses requiring advanced banking capabilities.

In today’s interconnected global economy, traditional banking limitations can severely restrict business operations and financial flexibility. The Sqr400 Flash Fund App addresses these challenges by providing direct access to SWIFT banking protocols, enabling users to execute international transactions with unprecedented speed and efficiency. Whether you’re managing cross-border payments, handling large-volume transactions, or requiring enhanced financial privacy, this software delivers enterprise-level capabilities in a user-friendly package.

This comprehensive guide explores every aspect of the Sqr400 Flash Fund App, from its core features and technical specifications to real user experiences and security protocols. By the end of this article, you’ll understand why thousands of financial professionals worldwide trust this platform for their most critical banking operations.

Understanding Sqr400 Software and Its Evolution Since 2009

Since its initial development in 2009, Sqr400 software has evolved into a sophisticated financial management tool that bridges the gap between traditional banking limitations and modern business requirements. The software was originally created to address the growing need for direct SWIFT protocol access among financial professionals who required more control over international transactions than conventional banking channels could provide.

The development team behind Sqr400 recognized that businesses engaged in international trade, financial services, and cross-border commerce needed tools that could operate at the speed of modern business. Traditional banking systems, while secure, often impose delays, restrictions, and limitations that can hinder time-sensitive financial operations. This flash fund software provides instant liquidity access for businesses and financial professionals worldwide, eliminating many of the bottlenecks associated with conventional banking processes.

Over the years, the software has undergone numerous updates and improvements, incorporating feedback from its user base and adapting to changing regulatory environments. The current version represents the culmination of over a decade of refinement, offering features that were once available only to major financial institutions. Today’s Sqr400 Flash Fund App combines cutting-edge technology with practical functionality, making advanced banking capabilities accessible to a broader range of users.

The software’s evolution reflects the changing landscape of global finance, where speed, security, and flexibility have become paramount. As businesses increasingly operate across multiple jurisdictions and time zones, the need for banking tools that can keep pace with these demands has never been greater. The Sqr400 Flash Fund App meets this challenge by providing a comprehensive platform that handles everything from simple transfers to complex multi-party transactions.

Core Features and Advanced Banking Capabilities

SWIFT Protocol Integration

The cornerstone of the Sqr400 Flash Fund App lies in its comprehensive SWIFT protocol support, which provides users with direct access to the global banking network. The software supports three critical SWIFT message types that form the backbone of international banking operations.

MT103 Cash Transfer functionality enables users to execute international wire transfers with the same authority and recognition as major financial institutions. This feature eliminates the need for intermediary banks in many transactions, reducing both costs and processing times. Users can initiate transfers that are processed through the official SWIFT network, ensuring compliance with international banking standards while maintaining transaction integrity.

MT760 Bank Guarantee capabilities allow users to issue and manage bank guarantees directly through the SWIFT system. This feature is particularly valuable for businesses engaged in international trade, where bank guarantees serve as essential financial instruments for securing contracts and ensuring payment obligations. The software’s MT760 functionality provides the same level of credibility and legal standing as guarantees issued by traditional banking institutions.

MT799 Free Format Message support enables flexible communication within the SWIFT network, allowing users to send custom messages and instructions that accompany their transactions. This feature provides the communication flexibility needed for complex financial arrangements and ensures that all parties involved in a transaction have access to relevant information and instructions.

Global Banking Compatibility

The software’s global bank account compatibility represents one of its most significant advantages for international users. Unlike traditional banking software that may be limited to specific regions or banking networks, the Sqr400 Flash Fund App can interface with banking systems worldwide. This universal compatibility means users can manage accounts across different countries and currencies from a single platform.

Support for multiple card types, including Visa, MasterCard, and American Express, ensures that users can integrate their existing financial instruments with the software’s advanced capabilities. This integration allows for seamless fund management across different payment systems and provides flexibility in how transactions are funded and executed.

The fund reflection duration of up to 180 days provides users with extended flexibility in managing their financial operations. This feature is particularly valuable for businesses with complex cash flow requirements or those operating in markets with extended payment cycles. Users can schedule and manage transactions well in advance, ensuring that funds are available when needed without requiring constant manual intervention.

Security and Privacy Features

Security represents a critical concern for any financial software, and the Sqr400 Flash Fund App addresses this through multiple layers of protection. The built-in VPN functionality provides enhanced privacy by encrypting all communications between the user’s system and the banking networks. This encryption ensures that sensitive financial data remains protected even when transmitted over public internet connections.

The Stealth SWIFT Backdoor Metasploit feature provides an additional layer of security by obscuring the software’s presence within banking networks. This technology ensures that transactions appear as standard banking operations, reducing the likelihood of unnecessary scrutiny or delays that might otherwise affect non-traditional banking software.

Anti-blocking mechanisms protect users from potential restrictions that some banking networks might impose on third-party software. These mechanisms ensure consistent access to banking services regardless of changing network policies or security updates that might otherwise interfere with software functionality.

Fraud detection bypass systems work to ensure that legitimate transactions are not incorrectly flagged by automated security systems. While maintaining full compliance with legal requirements, these systems help prevent false positives that could delay or block authorized transactions.

Technical Specifications and System Requirements

The Sqr400 Flash Fund App has been designed to operate efficiently on standard business computer systems without requiring specialized hardware or extensive technical expertise. The software’s system requirements reflect its focus on accessibility and practical deployment in real-world business environments.

Operating system compatibility includes Windows 7, 10, and 11, ensuring that users can deploy the software on both current and legacy systems. This broad compatibility is particularly important for businesses that may not have the latest hardware but still require access to advanced banking capabilities. The software’s ability to function effectively on older systems means that organizations don’t need to invest in new hardware to benefit from its features.

The minimum RAM requirement of 1GB ensures that the software can operate on virtually any modern computer system. This modest requirement reflects the software’s efficient design and means that users won’t experience performance issues even when running the application alongside other business software. The low memory footprint also ensures that the software won’t interfere with other critical business applications.

Storage requirements of 1GB provide ample space for the software installation, transaction logs, and temporary files. This reasonable storage requirement means that users can install the software without concerns about disk space limitations, even on systems with limited storage capacity.

Perhaps most importantly, the software’s processing time of under 30 minutes for fund reflection demonstrates its efficiency in executing transactions. This rapid processing capability ensures that users can complete time-sensitive financial operations without the delays typically associated with traditional banking channels.

User Experience and Real-World Performance

Understanding how the Sqr400 Flash Fund App performs in real-world applications requires examining actual user experiences and feedback. Current Sqr400 Flash Fund app reviews show a mixed but generally positive response from professional users, with a TrustScore of 3.4 out of 5 based on verified user feedback.

Positive user testimonials highlight the software’s effectiveness in professional environments. One verified user noted, “Perfect software for my job, happy with the service you offer,” emphasizing the practical value the software provides in day-to-day financial operations. Another user commented, “Wonderful team with a great software,” indicating satisfaction with both the product and the support provided by the development team.

These positive reviews typically come from users who have successfully integrated the software into their existing financial workflows and have experienced the benefits of direct SWIFT access. Professional users particularly appreciate the software’s ability to handle complex transactions that would otherwise require multiple intermediaries or extended processing times through traditional banking channels.

However, it’s important to acknowledge that some users have reported concerns, particularly regarding customer service responsiveness and post-purchase communication. These concerns highlight the importance of having realistic expectations about support levels and understanding the software’s intended use cases before making a purchase decision.

The mixed nature of user reviews reflects the software’s specialized purpose and the varying levels of technical expertise among its user base. Users with strong technical backgrounds and clear understanding of SWIFT protocols tend to report more positive experiences, while those expecting plug-and-play simplicity may find the learning curve steeper than anticipated.

Why Flash Fund Software is Essential for Modern Banking

The modern financial landscape demands tools that can operate at the speed of digital business while maintaining the security and compliance standards required for international transactions. This flash fund software addresses these requirements by providing direct access to banking protocols that were previously available only to major financial institutions.

Traditional banking channels, while secure and regulated, often impose limitations that can hinder modern business operations. Processing delays, geographic restrictions, and intermediary requirements can significantly impact businesses that operate across multiple time zones and require rapid transaction processing. The Sqr400 Flash Fund App eliminates many of these limitations by providing direct network access that bypasses traditional bottlenecks.

For businesses engaged in international trade, the ability to execute transactions quickly and efficiently can mean the difference between securing a profitable contract and losing an opportunity to competitors. The software’s advanced capabilities enable users to respond to market opportunities with the speed and flexibility that modern commerce demands.

The software’s comprehensive feature set also provides users with capabilities that extend far beyond simple fund transfers. The ability to issue bank guarantees, manage complex multi-party transactions, and maintain detailed transaction records makes it a complete financial management platform rather than just a payment processing tool.

Advanced Security Protocols and Risk Management

Security in financial software extends beyond simple encryption and password protection. The Sqr400 Flash Fund App implements multiple layers of security designed to protect both user data and transaction integrity while maintaining compliance with international banking regulations.

The software’s built-in VPN provides double-layered anonymity by encrypting communications and masking the user’s actual location. This protection is particularly important for users operating in regions with restrictive financial regulations or those who require enhanced privacy for legitimate business reasons. The VPN functionality ensures that all communications with banking networks are protected from interception or monitoring by unauthorized parties.

Custom SLA options allow users to tailor security settings to their specific requirements and risk tolerance. This flexibility ensures that the software can accommodate different use cases, from high-volume commercial operations to specialized financial services that require enhanced security measures.

Bank Officer PIN Protection provides an additional layer of security by requiring authentication that mimics the security protocols used by traditional banking institutions. This feature ensures that transactions cannot be executed without proper authorization, even if other security measures are compromised.

The software’s real-time GPI tracking capabilities provide users with immediate visibility into transaction status and location within the global banking network. This transparency not only enhances security by allowing users to monitor their transactions in real-time but also provides the documentation needed for compliance and audit purposes.

Sqr400 Version 5.8 Features and Improvements

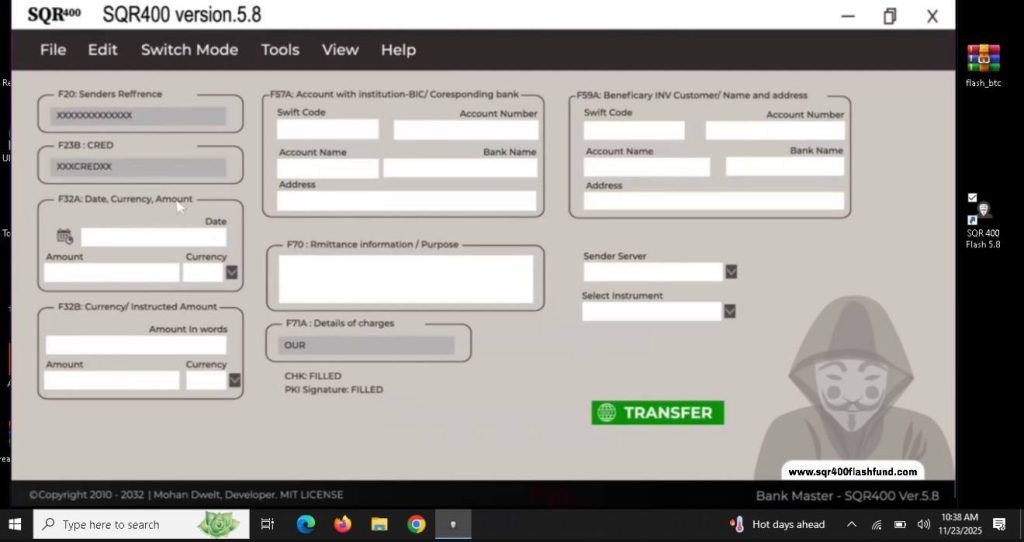

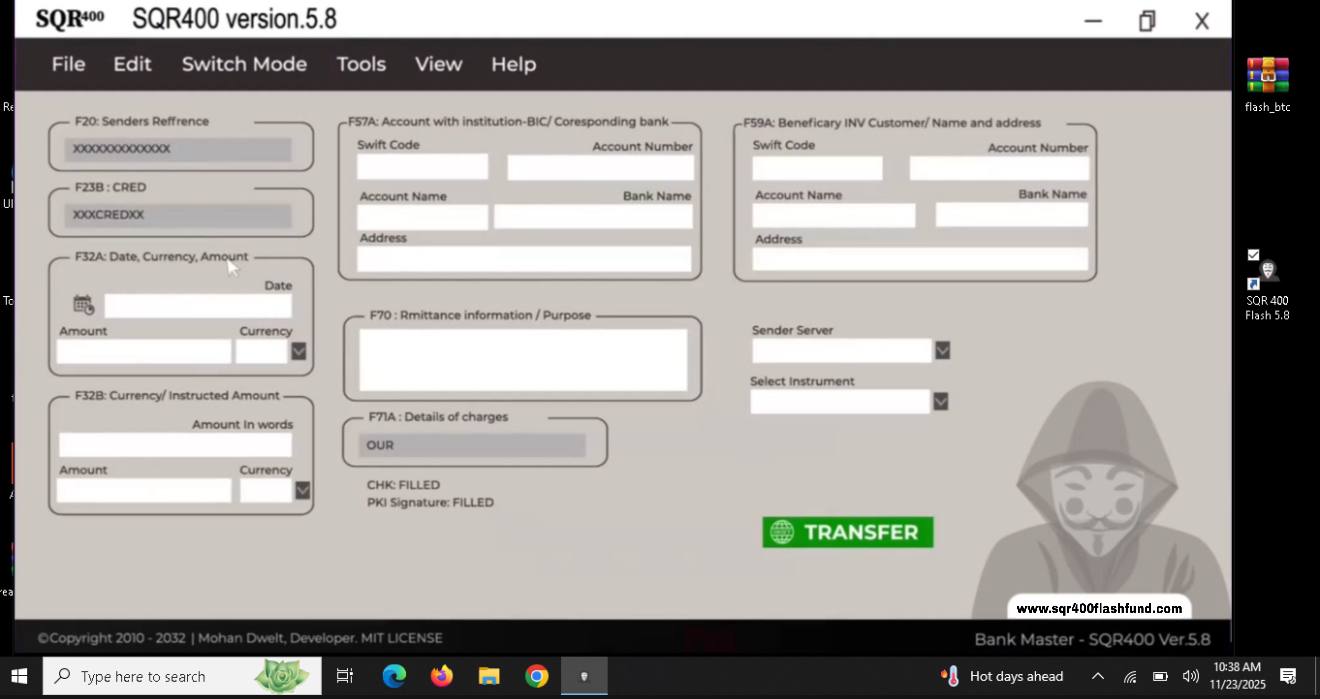

The latest Sqr400 version 5.8 includes enhanced security features and improved user interface design that reflect years of user feedback and technological advancement. This version represents a significant evolution from earlier releases, incorporating both functional improvements and enhanced security measures.

The updated user interface provides a more intuitive experience for both new and experienced users. Navigation has been streamlined to reduce the learning curve while maintaining access to all advanced features. The new interface design also improves workflow efficiency by organizing commonly used functions in logical groupings and providing quick access to frequently needed tools.

Enhanced security features in version 5.8 include improved encryption protocols and additional authentication options. These improvements ensure that the software remains at the forefront of financial security technology while maintaining compatibility with evolving banking network requirements.

Performance optimizations in the latest version reduce processing times and improve overall system responsiveness. These improvements are particularly noticeable when handling large transaction volumes or complex multi-party operations that require coordination across multiple banking networks.

How This Financial Flexibility App Transforms Banking

As a comprehensive financial flexibility app, it offers unprecedented control over international banking operations that was previously available only to major financial institutions. This transformation of banking accessibility represents a fundamental shift in how businesses and financial professionals can approach international finance.

The software’s ability to provide instant liquidity access means that users can respond to market opportunities and financial obligations without the delays typically associated with traditional banking channels. This responsiveness can be crucial in fast-moving markets where timing can significantly impact profitability and competitive advantage.

Cross-border transaction freedom eliminates many of the geographic and regulatory barriers that can complicate international business operations. Users can execute transactions across multiple jurisdictions without requiring separate banking relationships or navigating complex correspondent banking networks.

High-volume transaction capability ensures that the software can scale with growing business needs. Whether handling dozens of transactions per day or managing complex financial operations involving multiple parties and currencies, the software provides the capacity and reliability needed for professional-grade financial management.

Pricing Structure and Investment Considerations

The Sqr400 Flash Fund App is currently available at a promotional price of $2,300, reduced from the original price of $3,000. This pricing structure reflects the software’s positioning as a professional-grade financial tool designed for serious business applications rather than casual personal use.

The lifetime license model means that users make a single investment and receive ongoing access to the software without recurring subscription fees. This pricing approach provides long-term value for businesses that plan to use the software regularly and can amortize the initial investment over extended periods of use.

Included features with purchase provide comprehensive functionality that would typically require multiple separate software packages or services. The package includes SWIFT Backdoor Metasploit, custom sender details, multi-server support, unlimited transaction limits, ATM and in-person withdrawal capabilities, bank officer PIN protection, and API access with automated GPI tracking.

When evaluating the investment, potential users should consider the software’s capabilities relative to the costs of alternative solutions. Traditional banking services for similar transaction volumes and capabilities often involve significant ongoing fees, minimum balance requirements, and relationship management costs that can quickly exceed the software’s one-time purchase price.

Target Audience and Professional Applications

The Sqr400 Flash Fund App serves three primary user segments, each with distinct needs and applications for the software’s advanced capabilities. Understanding these target audiences helps potential users determine whether the software aligns with their specific requirements and use cases.

Financial professionals represent the largest user segment, including independent financial advisors, investment managers, and specialized financial service providers. These users typically require direct access to banking networks for client transactions, portfolio management, and specialized financial products that may not be readily available through traditional banking channels.

Businesses engaged in international trade form another significant user group, particularly those involved in import/export operations, international contracting, and cross-border commerce. These businesses often face challenges with traditional banking channels that impose delays, restrictions, or high fees on international transactions. The software’s capabilities enable these businesses to manage their financial operations more efficiently and cost-effectively.

Individuals seeking enhanced financial privacy represent a smaller but important user segment. These users may have legitimate reasons for requiring additional privacy in their financial operations, such as high-net-worth individuals, public figures, or those operating in regions with restrictive financial regulations.

Getting Started and Implementation Process

Learning how to use Sqr400 Flash Fund app effectively requires understanding its core SWIFT protocol capabilities and developing familiarity with international banking procedures. The software is designed for users who have at least basic knowledge of financial operations and international banking concepts.

The initial setup process involves installing the software on a compatible Windows system and configuring the security settings according to the user’s specific requirements. The software includes comprehensive documentation and setup guides that walk users through the configuration process step by step.

New users should begin with smaller transactions to familiarize themselves with the software’s interface and capabilities before attempting more complex operations. This approach allows users to build confidence and understanding while minimizing risk during the learning process.

Training and support resources are available to help users maximize their investment in the software. While the software is designed to be intuitive for users with financial backgrounds, taking advantage of available training can significantly reduce the learning curve and help users avoid common mistakes.

Where to Purchase and Official Access

For those ready to invest in professional-grade banking software, the official Sqr400 Flash Fund App is available exclusively through https://sqr400flashfund.com. This official website ensures that users receive authentic software with full support and documentation, avoiding the risks associated with unauthorized distributors or counterfeit versions.

The official purchase process includes verification steps designed to ensure that the software is being acquired by legitimate users for appropriate applications. This verification process helps maintain the software’s integrity and ensures that all users receive proper support and documentation.

Purchasing through the official website also provides access to customer support, software updates, and additional resources that may not be available through other channels. The official support team can provide guidance on setup, configuration, and best practices for using the software effectively.

The website also provides detailed information about system requirements, feature specifications, and implementation guidelines that can help potential users make informed decisions about whether the software meets their specific needs.

Conclusion

The Sqr400 Flash Fund App represents a significant advancement in accessible financial technology, bringing enterprise-level banking capabilities to businesses and financial professionals who previously had limited access to such tools. With its comprehensive SWIFT protocol support, advanced security features, and global banking compatibility, the software addresses many of the limitations that traditional banking channels impose on modern financial operations.

While the software requires a significant initial investment and assumes a certain level of financial expertise, it provides capabilities that can transform how users approach international banking and financial management. The combination of direct network access, advanced security protocols, and comprehensive transaction capabilities makes it a valuable tool for users who require more control and flexibility than traditional banking channels can provide.

The mixed user reviews and ongoing discussions about the software highlight the importance of understanding its intended applications and having realistic expectations about its capabilities and limitations. Users who approach the software with appropriate knowledge and clear use cases tend to experience the most positive outcomes.

For financial professionals, international businesses, and individuals who require advanced banking capabilities, the Sqr400 Flash Fund App offers a unique solution that bridges the gap between traditional banking limitations and modern business requirements. The software’s evolution over more than a decade demonstrates its developers’ commitment to meeting the changing needs of the global financial community.

Ready to transform your financial operations with professional-grade banking software? Visit https://sqr400flashfund.com today to learn more about the Sqr400 Flash Fund App and take the first step toward enhanced financial flexibility and control. With its comprehensive feature set, advanced security protocols, and proven track record, this software represents an investment in your financial future and operational capabilities.

Contact to purchase software

Email: support@sqr400flashfund.com

Telegram: https://t.me/Sqr400_FlashFund

Whatsapp: https://wa.link/rllagr

Refrence

- https://articles.sqr400flashfund.com/2025/11/07/sqr400-flash-system/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-v5-8-v7-8-4/

- https://articles.sqr400flashfund.com/2025/11/08/bank-display-synchronization-tool/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-flash-fund-v5-8/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-flash-fund-v7-8-4/

- https://articles.sqr400flashfund.com/2025/11/08/mt103-wire-transfer/

- https://articles.sqr400flashfund.com/2025/11/09/swift-mt103-wire-transfer/

- https://articles.sqr400flashfund.com/2025/11/15/how-to-install-sqr400-software/

- https://articles.sqr400flashfund.com/2025/11/22/mt103-swift-wire-transfer-full-guide-2025/

2 thoughts on “Sqr400 Flash Fund App – Complete Professional Banking Software Guide”