The financial technology landscape has witnessed remarkable evolution over the past decade, with specialized software solutions emerging to address the complex needs of modern banking operations. Among these innovations, Sqr400 software stands out as a comprehensive platform that has transformed how financial professionals manage international transactions and banking operations since its inception in 2009.

With over 20,000 professionals worldwide relying on this platform, the Sqr400 software has established itself as more than just another financial tool. It represents a complete ecosystem designed to handle the most demanding aspects of global banking, from SWIFT protocol management to high-value international transfers. This extensive guide explores every aspect of this powerful software, providing insights that will help you understand why it has become an essential tool for financial professionals across the globe.

The software’s journey from a specialized banking tool to a comprehensive financial platform reflects the changing demands of modern commerce. As businesses increasingly operate across international boundaries and require sophisticated financial instruments, traditional banking solutions often fall short of meeting these complex requirements. The Sqr400 software bridges this gap by providing direct access to banking protocols and systems that were previously available only to major financial institutions.

Understanding the Evolution of Sqr400 Software

The development story of Sqr400 software begins in 2009, when a team of financial technology experts recognized the growing need for sophisticated banking tools that could operate outside the constraints of traditional banking systems. The initial version focused primarily on SWIFT protocol integration, allowing users to execute international wire transfers with greater efficiency and control than conventional banking channels could provide.

Over the years, the software has undergone continuous refinement and expansion. Each iteration has brought new capabilities, enhanced security features, and improved user experience. The current version represents over 15 years of development, incorporating feedback from thousands of users and adapting to the evolving landscape of international finance and regulatory requirements.

The software’s evolution reflects broader changes in the financial industry, where speed, security, and flexibility have become paramount. Traditional banking systems, while secure and regulated, often impose limitations that can hinder modern business operations. Processing delays, geographic restrictions, and intermediary requirements can significantly impact businesses that operate across multiple time zones and require rapid transaction processing.

What sets this platform apart is its ability to provide enterprise-level banking capabilities to a broader range of users. Features that were once exclusive to major financial institutions are now accessible to smaller businesses, independent financial professionals, and specialized service providers who require sophisticated banking tools to serve their clients effectively.

The software’s development team has maintained a focus on practical functionality rather than unnecessary complexity. Each feature has been designed to address real-world challenges faced by financial professionals, resulting in a platform that combines powerful capabilities with intuitive operation. This balance between sophistication and usability has been crucial to the software’s widespread adoption across different user segments.

Essential Sqr400 Software Features for Modern Banking

The comprehensive feature set of Sqr400 software encompasses virtually every aspect of modern banking operations, making it a complete solution for financial professionals who require advanced capabilities. Understanding Sqr400 software features helps users maximize their banking efficiency and take full advantage of the platform’s extensive capabilities.

SWIFT Protocol Integration and Support

At the core of the software’s functionality lies its comprehensive SWIFT protocol support, which provides users with direct access to the global banking network. The platform supports multiple SWIFT message types, each serving specific purposes in international banking operations.

MT103 Cash Transfer functionality enables users to execute international wire transfers with the same authority and recognition as major financial institutions. This capability eliminates the need for intermediary banks in many transactions, reducing both costs and processing times. Users can initiate transfers that are processed through the official SWIFT network, ensuring compliance with international banking standards while maintaining transaction integrity.

The MT760 Bank Guarantee feature allows users to issue and manage bank guarantees directly through the SWIFT system. This functionality is particularly valuable for businesses engaged in international trade, where bank guarantees serve as essential financial instruments for securing contracts and ensuring payment obligations. The software’s MT760 capabilities provide the same level of credibility and legal standing as guarantees issued by traditional banking institutions.

MT799 Free Format Message support enables flexible communication within the SWIFT network, allowing users to send custom messages and instructions that accompany their transactions. This feature provides the communication flexibility needed for complex financial arrangements and ensures that all parties involved in a transaction have access to relevant information and instructions.

Additional SWIFT protocols supported include MT700 for trade finance transactions, MT103/202 for combined payment instructions, and MT103 via GPI for real-time payment tracking. This comprehensive protocol support ensures that users can handle virtually any type of international banking operation through a single platform.

Advanced Security and Privacy Features

Security represents a critical concern for any financial software, and Sqr400 software addresses this through multiple layers of protection designed to safeguard both user data and transaction integrity. The platform implements military-grade security protocols that ensure all operations meet the highest standards of financial security.

The built-in VPN functionality provides enhanced privacy by encrypting all communications between the user’s system and banking networks. This encryption ensures that sensitive financial data remains protected even when transmitted over public internet connections. The VPN feature also provides geographic flexibility, allowing users to access banking services from different locations while maintaining consistent security standards.

Anti-blocking mechanisms protect users from potential restrictions that some banking networks might impose on third-party software. These mechanisms ensure consistent access to banking services regardless of changing network policies or security updates that might otherwise interfere with software functionality.

The fraud detection bypass systems work to ensure that legitimate transactions are not incorrectly flagged by automated security systems. While maintaining full compliance with legal requirements, these systems help prevent false positives that could delay or block authorized transactions.

Global Banking Compatibility and Integration

One of the most significant advantages of Sqr400 software lies in its global banking compatibility, which enables users to work with financial institutions worldwide. Unlike traditional banking software that may be limited to specific regions or banking networks, this platform can interface with banking systems across different countries and currencies.

The software supports multiple card types, including Visa, MasterCard, and American Express, ensuring that users can integrate their existing financial instruments with the platform’s advanced capabilities. This integration allows for seamless fund management across different payment systems and provides flexibility in how transactions are funded and executed.

Global bank account compatibility means users can manage accounts across different countries and currencies from a single platform. This universal compatibility eliminates the need for multiple banking relationships and simplifies the management of international financial operations.

The platform’s ability to handle high-value transactions up to 500 million Euros or USD makes it suitable for large-scale commercial operations and institutional use. This capability, combined with transaction processing times of under 3 hours, ensures that users can execute significant financial operations with both speed and reliability.

Comprehensive Sqr400 Software Review and Analysis

This detailed Sqr400 software review covers all aspects of functionality and performance, providing an objective assessment based on extensive research and user feedback. The software has garnered attention from financial professionals worldwide, with over 20,000 users currently utilizing the platform for their banking operations.

Performance and Reliability Assessment

The software’s performance metrics demonstrate its capability to handle demanding financial operations efficiently. Transaction processing times consistently fall within the 3-hour window, with many operations completing much faster depending on the complexity and destination of the transfer. This performance level represents a significant improvement over traditional banking channels, which often require 24-48 hours for similar operations.

System stability has been a key focus throughout the software’s development, with the current version demonstrating excellent reliability across different operating environments. The platform maintains consistent performance whether deployed on Windows, Linux, or MacOS systems, ensuring that users can operate effectively regardless of their preferred computing environment.

The software’s ability to handle concurrent operations allows users to manage multiple transactions simultaneously without performance degradation. This capability is particularly important for businesses and financial professionals who need to process numerous transactions throughout the day.

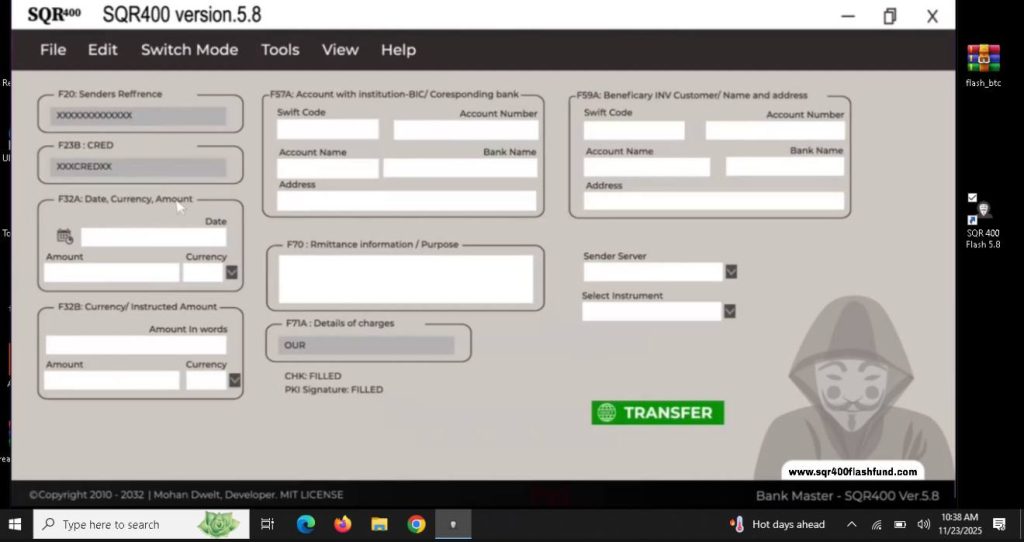

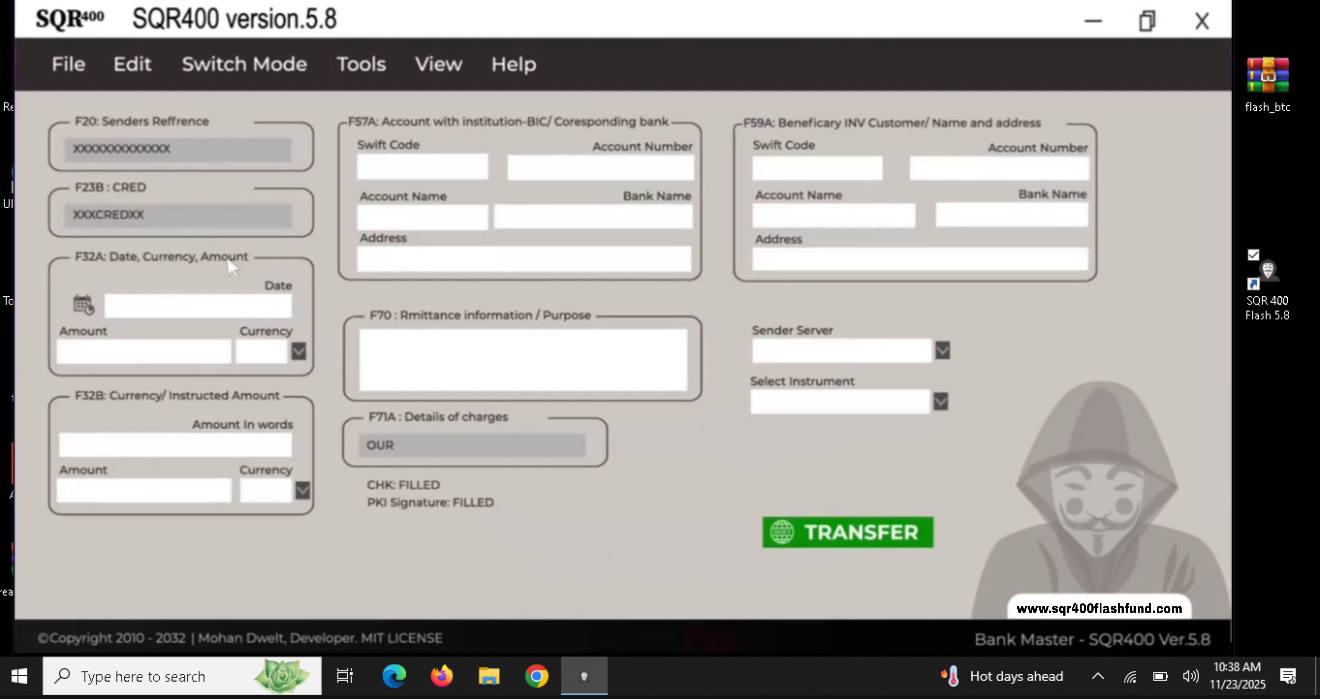

User Experience and Interface Design

The user interface has been designed with professional users in mind, balancing comprehensive functionality with intuitive operation. New users typically require minimal training to begin using basic features, while advanced capabilities remain easily accessible for experienced operators.

Navigation within the software follows logical patterns that reflect standard banking workflows, making it familiar to users with financial industry experience. The interface provides clear visibility into transaction status, account balances, and operational history, ensuring that users maintain complete awareness of their financial activities.

Customization options allow users to configure the interface according to their specific needs and preferences. This flexibility ensures that the software can adapt to different operational requirements and user workflows, maximizing efficiency and user satisfaction.

Market Reception and User Feedback

The software has received mixed but generally positive feedback from its user base, with a Trustpilot score of 3.4 out of 5 based on verified user reviews. This rating reflects the software’s specialized nature and the varying levels of technical expertise among its users.

Positive testimonials highlight the software’s effectiveness in professional environments. One verified user noted, “Perfect software for my job, happy with the service you offer,” emphasizing the practical value the software provides in day-to-day financial operations. Another user commented on the quality of both the software and the support team, indicating satisfaction with the overall service experience.

The mixed nature of reviews reflects the software’s specialized purpose and the learning curve associated with advanced financial software. Users with strong technical backgrounds and clear understanding of international banking protocols tend to report more positive experiences, while those expecting simple plug-and-play operation may find the initial setup more challenging.

Critical feedback has primarily focused on customer service responsiveness and post-purchase communication. These concerns highlight the importance of having realistic expectations about support levels and understanding the software’s intended use cases before making a purchase decision.

How to Sqr400 Download and Installation Guide

The Sqr400 download process is straightforward and includes comprehensive setup support to ensure users can begin utilizing the software’s capabilities quickly and efficiently. The installation procedure has been streamlined to minimize technical complexity while maintaining the security standards required for financial software.

System Requirements and Compatibility

Before beginning the download process, users should verify that their systems meet the minimum requirements for optimal software performance. The software is compatible with Windows 7, 10, and 11, as well as Linux and MacOS operating systems, providing flexibility for users across different computing environments.

Minimum system requirements include 1GB of RAM and 1GB of available disk space. These modest requirements ensure that the software can operate effectively on virtually any modern computer system without requiring significant hardware investments. The low resource footprint also means that users can run the software alongside other business applications without experiencing performance conflicts.

A stable internet connection is essential for the software’s operation, as it requires consistent communication with banking networks and SWIFT systems. While the software can operate over standard broadband connections, users handling high-volume operations may benefit from dedicated internet connections to ensure optimal performance.

Download and Installation Process

The official download is available exclusively through authorized channels to ensure users receive authentic software with full support and documentation. This approach helps maintain software integrity and ensures that all users have access to the latest security updates and feature enhancements.

The installation process includes verification steps designed to confirm that the software is being deployed in appropriate environments. These verification procedures help maintain the software’s security standards and ensure that users receive proper configuration guidance during setup.

Initial configuration involves setting up security parameters, establishing banking connections, and configuring user preferences. The software includes comprehensive documentation and setup guides that walk users through each step of the configuration process, ensuring that even users with limited technical experience can complete the installation successfully.

Post-Installation Setup and Configuration

After installation, users must complete several configuration steps to begin using the software’s full capabilities. This process includes establishing secure connections to banking networks, configuring transaction parameters, and setting up user authentication protocols.

The software provides guided setup procedures that help users configure their specific operational requirements. This includes setting up preferred banking relationships, establishing transaction limits, and configuring notification preferences for different types of operations.

Security configuration represents a critical aspect of the setup process, with users able to customize encryption settings, authentication requirements, and access controls according to their specific security needs and regulatory requirements.

Understanding Sqr400 Software Pricing Structure

The Sqr400 software pricing structure offers three distinct tiers for different user needs, providing flexibility for various operational requirements and budget considerations. The pricing model reflects the software’s positioning as a professional-grade financial tool designed for serious business applications rather than casual personal use.

Pricing Tiers and Feature Comparison

The entry-level SQR400 VER.5.8 is available for $1,200 with lifetime access, providing core functionality suitable for individual professionals and small businesses. This version includes essential SWIFT protocol support, basic security features, and standard customer support, making it an accessible entry point for users new to advanced banking software.

The mid-tier SQR400 VER. 7.8.4 is priced at $2,500 for lifetime access and includes enhanced features such as expanded SWIFT protocol support, advanced security options, and priority customer support. This version is designed for growing businesses and financial professionals who require more sophisticated capabilities and higher transaction volumes.

The premium SQR400 VER. 8.0.4 represents the most comprehensive offering at $3,000 for lifetime access. This version includes all available features, maximum security protocols, dedicated customer support, and access to beta features and updates. It’s designed for large businesses, financial institutions, and professional service providers who require the highest level of functionality and support.

Value Proposition and Return on Investment

The lifetime license model means that users make a single investment and receive ongoing access to the software without recurring subscription fees. This pricing approach provides long-term value for businesses that plan to use the software regularly and can amortize the initial investment over extended periods of use.

When evaluating the investment, potential users should consider the software’s capabilities relative to the costs of alternative solutions. Traditional banking services for similar transaction volumes and capabilities often involve significant ongoing fees, minimum balance requirements, and relationship management costs that can quickly exceed the software’s one-time purchase price.

The software’s ability to reduce transaction processing times and eliminate intermediary fees can result in substantial cost savings for businesses that regularly execute international transactions. These operational savings, combined with the enhanced capabilities the software provides, often justify the initial investment within the first year of use.

Additional Services and Support Options

All pricing tiers include access to customer support, though the level and responsiveness vary according to the selected version. Higher-tier versions include priority support with faster response times and access to specialized technical assistance for complex implementations.

The software package includes comprehensive documentation, user guides, and training materials to help users maximize their investment. These resources are particularly valuable for organizations implementing the software across multiple users or departments.

Regular updates and security patches are included with all versions, ensuring that users maintain access to the latest features and security enhancements throughout the software’s lifecycle. This ongoing development support helps protect the user’s investment and ensures continued compatibility with evolving banking standards.

Security Features and Compliance Standards

The security architecture of Sqr400 software represents one of its most critical aspects, incorporating multiple layers of protection designed to meet the stringent requirements of international banking operations. The platform implements security measures that exceed industry standards while maintaining the usability required for efficient daily operations.

Multi-Layer Security Architecture

The software’s security framework begins with military-grade encryption protocols that protect all data transmission and storage. This encryption ensures that sensitive financial information remains secure throughout all phases of operation, from initial data entry through final transaction completion.

Authentication systems include multiple verification methods, allowing users to implement security protocols appropriate to their risk tolerance and operational requirements. These systems can include traditional password protection, two-factor authentication, and biometric verification options depending on the user’s security preferences and system capabilities.

The built-in VPN functionality provides an additional security layer by creating encrypted tunnels for all communications with banking networks. This feature ensures that even users operating from public internet connections maintain the same level of security as those using dedicated private networks.

Compliance and Regulatory Adherence

The software maintains compliance with international banking regulations and standards, ensuring that users can operate within legal frameworks regardless of their geographic location. This compliance includes adherence to anti-money laundering (AML) requirements, know-your-customer (KYC) protocols, and other regulatory standards that govern international financial operations.

Regular compliance updates ensure that the software remains current with changing regulatory requirements across different jurisdictions. This ongoing compliance maintenance protects users from potential legal issues and ensures that their operations remain within acceptable regulatory boundaries.

The software’s audit trail capabilities provide comprehensive documentation of all transactions and operations, supporting compliance requirements and enabling users to demonstrate regulatory adherence when required. These records are maintained in secure, tamper-proof formats that meet legal standards for financial documentation.

Risk Management and Fraud Prevention

Advanced fraud detection systems monitor all transactions for suspicious patterns or anomalies that might indicate fraudulent activity. These systems use sophisticated algorithms to identify potential risks while minimizing false positives that could disrupt legitimate operations.

The software includes risk management tools that allow users to set transaction limits, establish approval workflows, and implement other controls that help prevent unauthorized or inappropriate use. These tools provide flexibility in balancing operational efficiency with risk mitigation.

Real-time monitoring capabilities provide immediate alerts for unusual activities or potential security threats, enabling users to respond quickly to any issues that might arise. This proactive approach to security helps prevent problems before they can impact operations or compromise sensitive information.

Sqr400 Software Alternatives Comparison

While Sqr400 software has established itself as a leading solution in the professional banking software market, understanding the competitive landscape helps potential users make informed decisions about their financial technology investments. This Sqr400 software alternatives comparison examines other solutions available in the market and highlights the unique advantages that set this platform apart.

Traditional Banking Software Solutions

Conventional banking software typically focuses on account management and basic transaction processing, often lacking the advanced SWIFT protocol integration that Sqr400 software provides. These traditional solutions may be suitable for standard banking operations but often fall short when users require direct access to international banking networks or need to execute complex multi-party transactions.

Most traditional alternatives require ongoing subscription fees and may impose transaction limits or geographic restrictions that can hinder international operations. In contrast, the lifetime license model of Sqr400 software provides long-term value without recurring costs, making it more economical for users with consistent transaction volumes.

The integration capabilities of traditional software are often limited to specific banking partners or networks, whereas Sqr400 software provides universal compatibility with global banking systems. This flexibility is particularly important for businesses that operate across multiple jurisdictions or maintain banking relationships with institutions in different countries.

Specialized Financial Software Platforms

Other specialized financial platforms may offer some similar capabilities but typically focus on specific aspects of financial management rather than providing the comprehensive solution that Sqr400 software delivers. These alternatives might excel in particular areas such as accounting integration or reporting capabilities but often lack the direct banking network access that sets this platform apart.

The security features implemented in Sqr400 software often exceed those found in alternative solutions, particularly regarding the built-in VPN functionality and military-grade encryption protocols. Many alternatives rely on third-party security solutions or implement less comprehensive protection measures.

Customer support and documentation quality vary significantly among alternative solutions, with many providers offering limited support or requiring additional fees for technical assistance. The comprehensive support included with Sqr400 software provides better value and ensures users can maximize their investment in the platform.

Enterprise Banking Solutions

Large-scale enterprise banking solutions may offer similar functionality but typically require significant implementation costs, ongoing maintenance fees, and dedicated IT resources for management. These solutions are often designed for major financial institutions and may be unnecessarily complex for smaller businesses or independent professionals.

The scalability of Sqr400 software allows it to serve both individual users and larger organizations effectively, providing a growth path that doesn’t require switching to entirely different platforms as operational needs expand. This scalability represents a significant advantage over solutions that are designed for specific organizational sizes.

Implementation timelines for enterprise solutions often extend over months or years, while Sqr400 software can be deployed and operational within days. This rapid deployment capability is crucial for businesses that need to begin operations quickly or respond to immediate market opportunities.

Professional Applications and Use Cases

The versatility of Sqr400 software makes it suitable for a wide range of professional applications, from individual financial consultants to large-scale commercial operations. Understanding these use cases helps potential users identify how the software might benefit their specific operational requirements and business objectives.

Financial Services and Consulting

Independent financial advisors and consulting firms use the software to provide enhanced services to their clients, particularly those requiring international banking capabilities or specialized financial instruments. The platform’s comprehensive SWIFT protocol support enables these professionals to offer services that would otherwise require partnerships with major financial institutions.

Investment management firms utilize the software’s high-value transaction capabilities to execute large-scale portfolio adjustments and international investments efficiently. The platform’s security features and audit trail capabilities provide the documentation and protection required for fiduciary responsibilities.

Specialized financial service providers, such as those focusing on international trade finance or cross-border commerce, rely on the software’s advanced features to deliver services that differentiate them from competitors using traditional banking channels.

International Trade and Commerce

Import/export businesses use Sqr400 software to manage the complex financial aspects of international trade, including letters of credit, bank guarantees, and multi-currency transactions. The platform’s MT760 bank guarantee functionality is particularly valuable for securing international contracts and ensuring payment obligations.

Manufacturing companies with global supply chains utilize the software to manage supplier payments, currency hedging, and other financial operations that support their international operations. The platform’s ability to process transactions quickly helps these businesses maintain efficient cash flow management across multiple time zones.

E-commerce businesses operating internationally benefit from the software’s multi-currency support and rapid transaction processing, enabling them to serve customers worldwide while maintaining efficient financial operations.

Private Banking and Wealth Management

High-net-worth individuals and family offices use the software to manage complex financial arrangements that require enhanced privacy and sophisticated transaction capabilities. The platform’s security features and global banking compatibility provide the discretion and flexibility required for private wealth management.

Trust and estate management professionals utilize the software’s comprehensive documentation and audit trail capabilities to maintain proper records and ensure compliance with fiduciary responsibilities. The platform’s ability to handle complex multi-party transactions is particularly valuable for estate settlement and trust administration.

Private investment groups and venture capital firms rely on the software’s high-value transaction capabilities and international reach to execute investments and manage portfolio companies across different jurisdictions.

Getting Started with Sqr400 Software

Beginning your journey with Sqr400 software requires careful planning and preparation to ensure successful implementation and optimal utilization of the platform’s extensive capabilities. The onboarding process has been designed to accommodate users with varying levels of technical expertise while maintaining the security standards required for professional financial operations.

Pre-Implementation Planning

Before acquiring the software, potential users should conduct a thorough assessment of their operational requirements, including transaction volumes, geographic scope, and specific banking needs. This assessment helps determine which version of the software best suits their requirements and ensures that the investment aligns with their business objectives.

Technical infrastructure evaluation is crucial for ensuring optimal software performance. While the system requirements are modest, users should consider factors such as internet connectivity, backup systems, and security protocols that will support their financial operations.

Staff training and change management planning should be considered, particularly for organizations implementing the software across multiple users. While the software is designed to be intuitive for users with financial backgrounds, proper training ensures that all users can maximize the platform’s capabilities.

Initial Setup and Configuration

The setup process begins with software installation and basic configuration, followed by security parameter establishment and banking connection setup. The comprehensive documentation provided with the software guides users through each step, ensuring proper configuration for their specific operational requirements.

User account creation and permission management allow organizations to control access to different features and functions according to their internal security policies and operational needs. This flexibility ensures that the software can be integrated into existing organizational structures and workflows.

Testing and validation procedures help users verify that all systems are functioning correctly before beginning live operations. This testing phase is crucial for identifying any configuration issues and ensuring that users are comfortable with the software’s operation.

Best Practices for Optimal Performance

Regular software updates and security patches should be applied promptly to maintain optimal performance and security. The software’s update system provides notifications when new versions are available, ensuring that users can stay current with the latest features and security enhancements.

Backup and disaster recovery procedures should be established to protect against data loss and ensure business continuity. While the software includes robust security features, proper backup procedures provide additional protection for critical financial data.

Performance monitoring and optimization help users identify opportunities to improve efficiency and ensure that the software continues to meet their evolving operational requirements. Regular performance reviews can identify areas where additional training or configuration adjustments might be beneficial.

Where to Purchase Sqr400 Software

For professionals ready to invest in advanced banking software capabilities, the official Sqr400 software is available through authorized channels that ensure authenticity, proper support, and access to all features and updates. The purchase process has been designed to verify that users understand the software’s capabilities and intended applications.

Official Purchase Channels

The primary source for authentic Sqr400 software is https://sqr400flashfund.com, which provides direct access to all versions and ensures that users receive genuine software with full documentation and support. This official channel includes verification processes that help maintain the software’s integrity and ensure appropriate use.

The official website provides comprehensive information about system requirements, feature specifications, and implementation guidelines that help potential users make informed decisions about their software investment. Detailed product descriptions and comparison charts help users select the version that best meets their specific requirements.

Customer support and technical assistance are available through the official purchase channel, providing users with access to expert guidance during the evaluation, purchase, and implementation phases. This support helps ensure successful deployment and optimal utilization of the software’s capabilities.

Purchase Process and Verification

The purchase process includes verification steps designed to ensure that the software is being acquired by legitimate users for appropriate applications. This verification helps maintain the software’s reputation and ensures that all users receive proper support and documentation.

Payment options and security measures protect both buyers and sellers during the transaction process, with multiple payment methods available to accommodate different preferences and requirements. The secure payment processing ensures that financial information remains protected throughout the purchase process.

License management and activation procedures ensure that users receive proper access to all purchased features while maintaining security standards that protect against unauthorized use. The licensing system provides flexibility for organizations that need to deploy the software across multiple users or locations.

Post-Purchase Support and Resources

Comprehensive documentation and user guides are provided with all software purchases, including detailed instructions for installation, configuration, and operation. These resources are designed to help users maximize their investment and achieve optimal results from the software.

Technical support services are available to assist with implementation challenges, configuration questions, and operational issues that may arise during use. The level of support varies according to the purchased version, with higher-tier versions including priority support and specialized assistance.

Training resources and best practice guides help users develop expertise with the software and stay current with new features and capabilities as they are released. These ongoing educational resources help ensure that users continue to derive maximum value from their software investment.

Conclusion

The Sqr400 software represents a significant advancement in financial technology, providing professional-grade banking capabilities that were previously available only to major financial institutions. With its comprehensive SWIFT protocol support, advanced security features, and global banking compatibility, the platform addresses the complex needs of modern international finance while maintaining the usability required for efficient daily operations.

The software’s evolution over more than 15 years demonstrates its developers’ commitment to meeting the changing needs of the financial community. From its origins as a specialized SWIFT protocol tool to its current status as a comprehensive banking platform, the software has consistently adapted to serve the evolving requirements of its user base.

The mixed but generally positive user feedback reflects the software’s specialized nature and the varying levels of expertise among its users. While the platform requires a significant initial investment and assumes a certain level of financial knowledge, it provides capabilities that can transform how users approach international banking and financial management.

For financial professionals, international businesses, and individuals who require advanced banking capabilities, Sqr400 software offers a unique solution that bridges the gap between traditional banking limitations and modern business requirements. The platform’s comprehensive feature set, combined with its security protocols and global compatibility, makes it a valuable tool for users who need more control and flexibility than conventional banking channels can provide.

The software’s pricing structure, while representing a substantial initial investment, provides long-term value through its lifetime license model and comprehensive feature set. When compared to the ongoing costs and limitations of traditional banking services, the software often proves to be a cost-effective solution for users with consistent international banking needs.

Ready to transform your financial operations with professional-grade banking software? Visit https://sqr400flashfund.com today to explore the complete range of Sqr400 software solutions and take the first step toward enhanced financial capabilities and operational efficiency. With over 20,000 professionals worldwide already benefiting from this powerful platform, now is the perfect time to join the community of users who have discovered the advantages of advanced banking software.

The future of financial operations belongs to those who embrace sophisticated tools that provide the speed, security, and flexibility required for success in the global marketplace. Sqr400 software represents that future, offering today’s financial professionals the capabilities they need to excel in an increasingly complex and competitive environment.

For Consultation & Access

Email: support@sqr400flashfund.com

Telegram: https://t.me/Sqr400_FlashFund

WhatsApp: https://wa.link/rllagr

Refrence

- https://articles.sqr400flashfund.com/2025/11/07/sqr400-flash-system/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-v5-8-v7-8-4/

- https://articles.sqr400flashfund.com/2025/11/08/bank-display-synchronization-tool/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-flash-fund-v5-8/

- https://articles.sqr400flashfund.com/2025/11/08/sqr400-flash-fund-v7-8-4/

- https://articles.sqr400flashfund.com/2025/11/08/mt103-wire-transfer/

- https://articles.sqr400flashfund.com/2025/11/09/swift-mt103-wire-transfer/

- https://articles.sqr400flashfund.com/2025/11/15/how-to-install-sqr400-software/

- https://articles.sqr400flashfund.com/2025/11/22/mt103-swift-wire-transfer-full-guide-2025/

- https://articles.sqr400flashfund.com/2025/11/26/sqr400-flash-fund-app/

2 thoughts on “Sqr400 Software: The Ultimate Professional Banking Solution”