Fake bank alerts have become one of the most prevalent financial scams targeting consumers today. These deceptive messages mimic legitimate communications from banks, creating a false sense of urgency that tricks recipients into revealing sensitive information or making hasty decisions. With reported losses exceeding $330 million in 2022 alone, understanding how to identify and protect yourself from these scams is more important than ever.

This comprehensive guide will help you recognize fake bank alerts, understand how they work, and provide effective strategies to protect your financial information. We’ll also introduce specialized tools designed to verify the authenticity of banking communications.

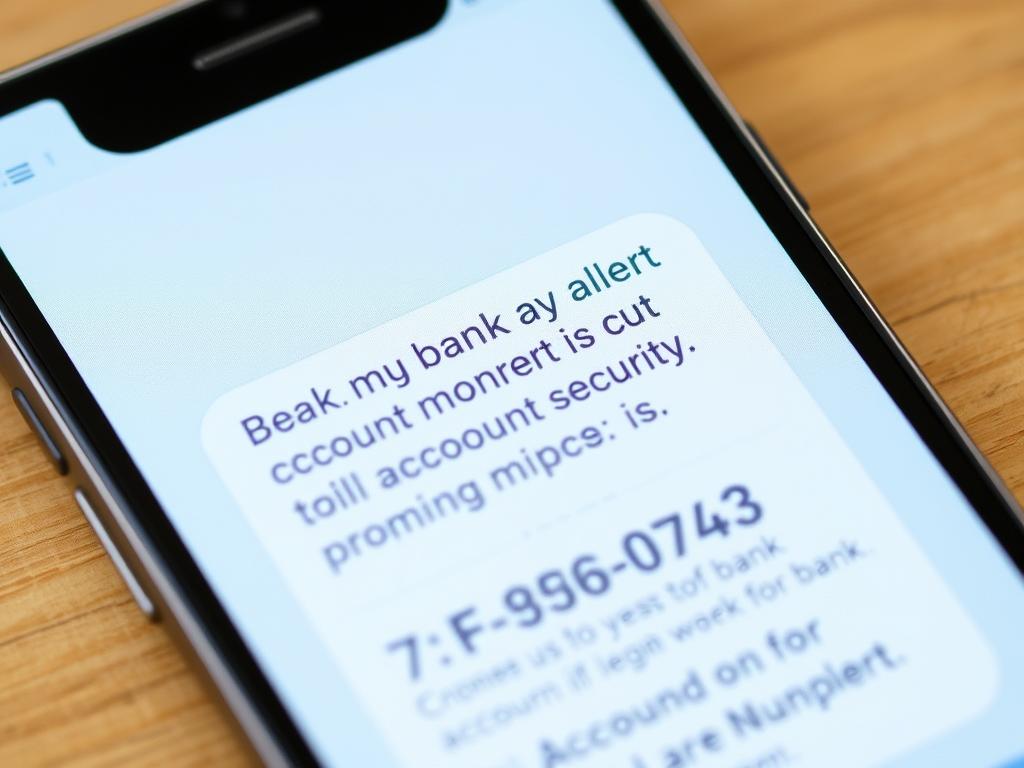

Example of a fake bank alert that appears legitimate but contains warning signs

What Are Fake Bank Alerts and How Do They Work?

Fake bank alerts are fraudulent messages designed to appear as if they’re coming from legitimate financial institutions. These scams typically arrive via text message or email and claim there’s an urgent issue with your account that requires immediate attention.

Common fake bank alert messages include:

- “Suspicious activity detected on your account”

- “Your account has been temporarily suspended”

- “Confirm this transaction of $XXX.XX”

- “Your account access will be restricted unless you verify your information”

These messages create artificial urgency, pushing you to act quickly without thinking critically. The scammers’ goal is to obtain your personal and financial information through one of several methods:

Phishing Links

The most common approach involves sending a text or email with a link to a fake website that mimics your bank’s legitimate site. Once you enter your login credentials or personal information, scammers capture this data to access your accounts.

Call-Back Scams

Some fake alerts provide a phone number and instruct you to call immediately. When you call, scammers pose as bank representatives and attempt to extract your personal information, account details, or one-time verification codes.

The Growing Sophistication of Fake Bank Alerts

Modern fake bank alerts have become increasingly sophisticated, employing several advanced techniques:

- Spoofing: Scammers can make messages appear to come from your bank’s actual phone number or email address.

- Personalization: Some scams include personal details (like your name or partial account number) obtained from data breaches to appear more legitimate.

- Professional design: Fraudulent websites and messages often perfectly mimic official bank branding, logos, and formatting.

- Timing: Scammers may time their attacks during weekends or holidays when bank customer service is less accessible.

Comparison showing subtle differences between legitimate and fraudulent bank alerts

How to Identify Fake Bank Alerts: 7 Warning Signs

Protecting yourself begins with knowing how to spot the warning signs of fake bank alerts. Here are seven key indicators that a message might be fraudulent:

1. Urgent Action Required

Fake alerts often create a false sense of urgency, claiming your account will be locked or funds will be lost if you don’t act immediately. Legitimate banks typically give reasonable timeframes for any required actions.

2. Requests for Personal Information

Legitimate banks will never ask for your full password, PIN, or one-time verification codes via text or email. Any message requesting this information is almost certainly fraudulent.

3. Suspicious Links

Hover over (don’t click) any links to see the actual URL. Fake alerts often use URLs that look similar to the bank’s legitimate website but contain subtle differences or unusual domains.

4. Grammar and Spelling Errors

Professional financial institutions have quality control processes. Messages with poor grammar, spelling mistakes, or unusual formatting are likely fraudulent.

5. Unfamiliar Sender Information

Check if the message comes from an unknown number or email address. Legitimate bank texts typically come from short codes (5-6 digit numbers) rather than regular phone numbers.

6. Generic Greetings

Legitimate bank communications usually address you by name. Messages starting with “Dear Customer” or similar generic greetings should raise suspicion.

Key warning signs that can help you identify fake bank alerts

Step-by-Step Guide to Protect Yourself from Fake Bank Alerts

Follow these essential steps to safeguard your financial information and avoid becoming a victim of fake bank alert scams:

- Verify your bank’s official communication methods and short codes

- Enable multi-factor authentication on all financial accounts

- Keep your contact information updated with your bank

- Install reputable security software on your devices

- Consider using specialized verification tools like SQR400 FlashFund

Before Receiving Alerts

- Don’t click on any links in the message

- Never reply with personal or account information

- Don’t call phone numbers provided in the message

- Take a screenshot of the message for reporting purposes

- Use verification software to check the alert’s authenticity

When Receiving Suspicious Alerts

- Contact your bank directly using the number on your card

- Report the scam to your financial institution

- Forward suspicious texts to SPAM (7726)

- Report to the FTC at ReportFraud.ftc.gov

- Monitor your accounts for unauthorized activity

Taking Action

Always verify suspicious alerts by contacting your bank through official channels

Verify Bank Alerts with SQR400 FlashFund Software

While following best practices is essential, specialized tools can provide an additional layer of security when dealing with bank alerts. The SQR400 FlashFund software offers advanced verification capabilities specifically designed to help you determine the authenticity of banking communications.

How SQR400 FlashFund Protects You

This specialized software provides real-time verification of bank alerts, transactions, and communications to help you distinguish between legitimate banking activities and potential scams. By analyzing multiple security parameters, the software can quickly identify suspicious patterns that might indicate fraud.

Advantages

- Real-time verification of bank alerts

- Detects sophisticated spoofing attempts

- Analyzes transaction patterns for anomalies

- User-friendly interface for quick verification

- Regular updates to counter new scam techniques

Limitations

- Requires initial setup with your banking details

- Works best when kept regularly updated

- Not a replacement for general security practices

Protect Your Financial Security Today

Don’t wait until you become a victim of fake bank alerts. The SQR400 FlashFund software provides the verification tools you need to protect your financial information from increasingly sophisticated scams.

Need assistance? Contact our support team via Telegram

Real-World Examples of Fake Bank Alerts

Understanding what fake bank alerts look like in practice can help you identify them more easily. Here are some common examples of fraudulent messages that consumers have reported:

Fake account suspension alert

Fraudulent transaction verification email

Fake security update message

“The most dangerous fake bank alerts are those that create a sense of urgency while appearing completely legitimate. Scammers know that fear of financial loss drives people to act quickly without verifying the message’s authenticity.”

Frequently Asked Questions About Fake Bank Alerts

What is a fake bank alert?

A fake bank alert is a fraudulent message that appears to come from a legitimate financial institution. These messages typically claim there’s an urgent issue with your account that requires immediate action. They’re designed to trick you into revealing sensitive information like account numbers, passwords, PINs, or to get you to transfer money. Fake bank alerts can arrive via text message, email, or even phone calls.

How can I spot a fake bank alert?

Look for these warning signs:

- Urgent language demanding immediate action

- Requests for personal information like passwords or PINs

- Generic greetings instead of your name

- Suspicious links or attachments

- Grammatical errors or unusual formatting

- Messages from unknown numbers or emails that don’t match your bank’s official contact information

When in doubt, contact your bank directly using the official phone number on your card or from their website.

What should I do if I receive a fake bank alert?

If you receive a suspicious bank alert:

- Don’t click any links or reply to the message

- Don’t call phone numbers provided in the message

- Contact your bank directly using official channels (the number on your card)

- Report the scam to your bank’s fraud department

- Forward suspicious texts to SPAM (7726)

- Report to the FTC at ReportFraud.ftc.gov

- Monitor your accounts for any unauthorized activity

Are there legitimate tools to verify bank alerts?

Yes, there are specialized tools designed to help verify the authenticity of bank communications. The SQR400 FlashFund software is specifically designed to analyze bank alerts and transactions to determine if they’re legitimate or potentially fraudulent. This software uses advanced algorithms to detect spoofing attempts and other common techniques used in fake bank alerts.

While no tool provides 100% protection, using specialized verification software alongside good security practices significantly reduces your risk of falling victim to fake bank alerts.

How does the SQR400 FlashFund software help with financial security?

The SQR400 FlashFund software provides several key security benefits:

- Real-time verification of bank alerts and communications

- Detection of sophisticated spoofing attempts that mimic legitimate bank messages

- Analysis of transaction patterns to identify potential fraud

- User-friendly interface that makes verification quick and simple

- Regular updates to protect against emerging scam techniques

By using this specialized software, you can quickly determine whether a bank alert is legitimate before taking any action, significantly reducing your risk of falling victim to scams.

How can I contact support for assistance?

If you have questions about fake bank alerts or need assistance with the SQR400 FlashFund software, you can contact our support team directly via Telegram at https://t.me/Sqr400_FlashFund. Our team is available to help with software installation, usage questions, and general advice on protecting yourself from financial scams.

Staying Protected Against Fake Bank Alerts

Fake bank alerts continue to evolve in sophistication, making them an ongoing threat to financial security. By understanding how these scams work, recognizing the warning signs, and implementing proper security measures, you can significantly reduce your risk of becoming a victim.

Remember that legitimate banks will never request sensitive information like passwords, PINs, or full account numbers via text or email. When in doubt, always contact your bank directly using official channels rather than responding to messages or clicking on links.

For those seeking additional protection, specialized verification tools like the SQR400 FlashFund software can provide an extra layer of security by helping you verify the authenticity of bank communications before taking action.

Taking control of your financial security with proper verification tools

Don’t Wait Until It’s Too Late

Protect yourself from fake bank alerts and financial fraud with the SQR400 FlashFund verification software. Take proactive steps to secure your financial information today.

Questions? Contact us via Telegram for immediate assistance